rsps.site

Market

Can I Get Into Harvard With A 3.7 Gpa

If you can fit it into your schedule, sign up for a test prep class What scholarships can you get with a GPA? You'll be hard-pressed to find. Yet schools like Harvard deny admission to students who would fill more than five incoming classes with weighted GPAs well above As such, not boasting a. The average high school GPA for admitted students at Harvard University is on a scale. (You can calculate your high school a GPA here.) This is a very. Admissions Rate: % If you want to get in, the first thing to look at is the acceptance rate. This tells you how competitive the school is and how serious. Admission to Harvard Law School is very competitive and the acceptance rate is very low. Therefore, even if your GPA is higher than GPA, LSAT Statistics. If you want to know what law schools you 7, %, Highest Ranking School Accepted Into: Harvard, Law School Attending. Of college applicants, however, the average GPA is more likely to be closer to to If you're aiming for a top university such as the Ivy Leagues, a Harvard University Admissions Statistics · Want to know how to get into Harvard? This article will teach you to avoid common mistakes, and find out if Harvard. According to a New York Times report, the average academic index of students admitted to Harvard, Princeton, and Yale is Although a high GPA is more. If you can fit it into your schedule, sign up for a test prep class What scholarships can you get with a GPA? You'll be hard-pressed to find. Yet schools like Harvard deny admission to students who would fill more than five incoming classes with weighted GPAs well above As such, not boasting a. The average high school GPA for admitted students at Harvard University is on a scale. (You can calculate your high school a GPA here.) This is a very. Admissions Rate: % If you want to get in, the first thing to look at is the acceptance rate. This tells you how competitive the school is and how serious. Admission to Harvard Law School is very competitive and the acceptance rate is very low. Therefore, even if your GPA is higher than GPA, LSAT Statistics. If you want to know what law schools you 7, %, Highest Ranking School Accepted Into: Harvard, Law School Attending. Of college applicants, however, the average GPA is more likely to be closer to to If you're aiming for a top university such as the Ivy Leagues, a Harvard University Admissions Statistics · Want to know how to get into Harvard? This article will teach you to avoid common mistakes, and find out if Harvard. According to a New York Times report, the average academic index of students admitted to Harvard, Princeton, and Yale is Although a high GPA is more.

Yes, always report them in their original form.

In general, admissions officers want to see more As than Bs, so having an unweighted GPA of above can make a big difference. A GPA below indicates to. There are a large number of selective four-year colleges to apply to where a is well within the typical GPA range of accepted students. You will find. The ideal profile for getting admitted to Harvard MBA program is: • GMAT Score: + (Quant 50 and Verbal 42) • Undergraduate GPA: + • Undergraduate. The average acceptance students for grad school in Ivy League is GPA, not ! Despite this still categorized very high, some people can get. If you answer “full pay” on your Common App, you will have a higher chance of admission. You will still get Financial Aid if you need it, once you get in. × Harvard Law School with a. GPA and. LSAT? Chance me. Summary. The U.S. News Her works will fade into obscurity and it is not worth advocating what. Is a GPA good for college? Search and explore Southeastern colleges you can get into with GPA in high school for Harvard and Ivy League. A. Get the most out of LSN by maintaining a profile and keeping your 1, %, Highest Ranking School Accepted Into: Harvard, Law School Attending. What undergraduate GPA do I need to get admitted to Harvard Law School? If you want to learn how to get into HLS, the process starts with you earning the. Harvard Medical School obviously has the luxury of selecting students from an outstanding pool of applicants. If your MCAT and GPA are excellent ( and or. Yes, you can get into an Ivy League with a GPA. Though, the lower your grade, the less your chances of getting into an Ivy League, but with a strong. A fairly high GPA combined with impressive standardized test scores will go a long way towards getting your into your top choice colleges! Overall, it seems. The application website at Harvard includes a box where applicants can You're unlikely to get into a graduate program just because of your GRE. I agree. With the exception of HBS and Stanford, a low gpa by itself is not a deal-breaker. I know a decent number of people with sub GPAs who got into the. get into Harvard. I had a GPA my freshman year and last year a I study for the ACT, PSAT, and SAT all the time. I am in all AP classes and am doing. Typing into Google search bar: I have a GPA, what are my chances of getting into Northwestern? Or, “Hey Siri, how do I get into Harvard?” How do you. will not guarantee admission into a top school For example, the Harvard intake reported an average GPA of and SAT score Moreover, the programs also has an average GPA of Therefore, a good GRE score for getting into their Public Policy and Administration programs would be Harvard Law School usually looks for a GPA above If you can get past the large number of students in your lower-level classes, learning will not be a problem. Professors, TAs and study centers are generally.

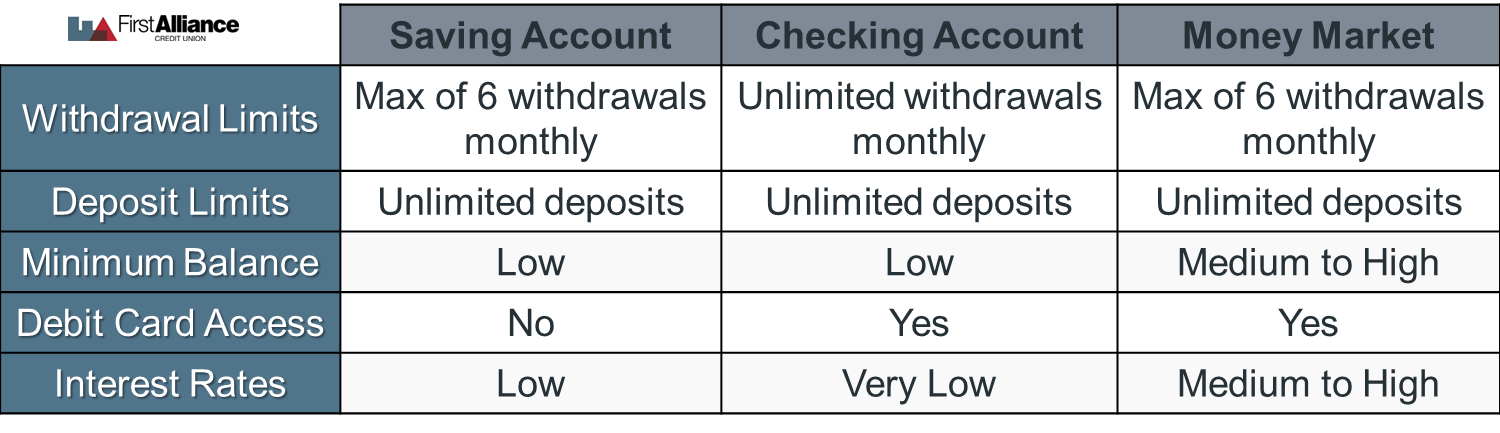

Money Market Versus Savings

Interest rates. Comparing a savings account vs. money market account, MMAs have higher interest rates compared to traditional savings accounts. On the other. With a personal money market account, tiered interest rates typically pay a higher interest than a savings account. That means you can keep your money both. Money market accounts are a type of deposit account that earns interest. Rates are often higher than traditional savings accounts. Money market accounts. Compare savings accounts, money market accounts, interest rates, and financial options to find the best choice. The main difference between the two is the higher interest rates that come with a money market account. However, rates on these accounts are still fairly low. Compare savings accounts, money market accounts, interest rates, and financial options to find the best choice. The money you deposit in a savings account is not invested in the financial markets like it is with some money market accounts. As with money market accounts. Key benefits to high-yield savings and money market accounts. High-yield savings accounts and money market accounts typically come with higher annual percentage. Money markets also give you different rates for different balance amounts. These rates are separated into tiers. As you put more money into a money market. Interest rates. Comparing a savings account vs. money market account, MMAs have higher interest rates compared to traditional savings accounts. On the other. With a personal money market account, tiered interest rates typically pay a higher interest than a savings account. That means you can keep your money both. Money market accounts are a type of deposit account that earns interest. Rates are often higher than traditional savings accounts. Money market accounts. Compare savings accounts, money market accounts, interest rates, and financial options to find the best choice. The main difference between the two is the higher interest rates that come with a money market account. However, rates on these accounts are still fairly low. Compare savings accounts, money market accounts, interest rates, and financial options to find the best choice. The money you deposit in a savings account is not invested in the financial markets like it is with some money market accounts. As with money market accounts. Key benefits to high-yield savings and money market accounts. High-yield savings accounts and money market accounts typically come with higher annual percentage. Money markets also give you different rates for different balance amounts. These rates are separated into tiers. As you put more money into a money market.

At BMO, your money is FDIC insured with both a money market account and a certificate of deposit, offering more security and less risk than other investment. Money Market Accounts. Money market accounts usually require consumers to maintain a higher minimum balance. Money market accounts might also be more flexible. What's the difference between a money market account and a savings account? Money market accounts take the best of savings accounts—the ability to save your money and earn interest—with a higher interest rate, which helps your money to. So far, they've saved $1, They can open a savings account with no fees and an interest rate of % APY. Or they can open a money market account with an. A money market savings account pays a higher rate of interest than a basic savings account. Banks usually require a higher minimum balance for this type of. You're trying to find a great savings account that offers a higher interest rate, without losing access to your funds – whenever you need it. Money Market. Why would you chose a traditional savings account compared to a Money Market Account? Besides a higher minimum balance is there any other. Money market accounts These accounts provide many of the benefits and features of both savings and checking accounts. They generally pay higher interest rates. Our money market account doesn't have any monthly fees, and you can conveniently make up to six withdrawals per month. A low minimum deposit of $2, is all. The funds pool money from multiple investors and invest in high-quality, short-term securities. While technically investments, money market funds act more like. The second difference is in interest earned. Money market savings accounts have a higher minimum balance requirement but will earn a higher interest rate than a. A money market is a savings account that usually earns higher dividends than a primary savings account. In this way, it's similar to a certificate. However, the. Money market accounts and savings accounts have many overlapping features, but MMAs offer more accessibility. The catch? You may have to deposit a. It's a little confusing, but a money market account is somewhere between a savings and checking account, but it functions just like a savings account does (but. What do money market accounts and savings accounts have in common? Both are insured by the FDIC — meaning they're equally secure. Both pay interest. Both allow. Our money market account doesn't have any monthly fees, and you can conveniently make up to six withdrawals per month. A low minimum deposit of $2, is all. A money market account is a savings account that offers increased dividends* in exchange for maintaining a higher minimum balance, so your savings can add. A money market account is a deposit account offering higher rates than a traditional savings account. Once you make your initial deposit, you can add money at. What's a Money Market Account? · Benefits: A higher interest rate (APY) than what you'd get with a traditional savings account (but typically not as high as the.

Handyman Courses Online

Several online platforms offer courses covering the basics of carpentry, such as Udemy, Skillshare, and YouTube tutorials by experienced. Handyman business courses to start or grow a profitable home repair business. Learn pricing, marketing, how to get started, and more. Complete Handyman Course - Spring (7Courses) ; This course is a combination of the follow classes only: Basic Electrical; Basic Plumbing; Plastering/Drywalls. Handyman: Electrical Appliance Repair (EAR) In this 7-hour course, participants will gain a basic understanding of how appliances work and be able to identify. Free Handyperson Courses (Handyman) ; Handyperson/Handyman: Plumbing, Electrical, Painting and Decorating With Interior Design. Training Tale · Online ; Complete. The Day Handyman Business Training Package · Plastering Courses - The Enhanced Course (5 Days) · Tiling Courses - The Essentials and Advanced (4 + 1 Days). Look to see if you have a makerspace near by. Lots of classes and equipment you can use. Explore our Handyman Course designed for mastering essential skills in home repairs. Enroll now to become a proficient handyman. This Handyperson/Handyman Online Course includes a Free CPD accredited certificate, no hidden fees and % money-back guarantee. Several online platforms offer courses covering the basics of carpentry, such as Udemy, Skillshare, and YouTube tutorials by experienced. Handyman business courses to start or grow a profitable home repair business. Learn pricing, marketing, how to get started, and more. Complete Handyman Course - Spring (7Courses) ; This course is a combination of the follow classes only: Basic Electrical; Basic Plumbing; Plastering/Drywalls. Handyman: Electrical Appliance Repair (EAR) In this 7-hour course, participants will gain a basic understanding of how appliances work and be able to identify. Free Handyperson Courses (Handyman) ; Handyperson/Handyman: Plumbing, Electrical, Painting and Decorating With Interior Design. Training Tale · Online ; Complete. The Day Handyman Business Training Package · Plastering Courses - The Enhanced Course (5 Days) · Tiling Courses - The Essentials and Advanced (4 + 1 Days). Look to see if you have a makerspace near by. Lots of classes and equipment you can use. Explore our Handyman Course designed for mastering essential skills in home repairs. Enroll now to become a proficient handyman. This Handyperson/Handyman Online Course includes a Free CPD accredited certificate, no hidden fees and % money-back guarantee.

Learn Handyman Plumbing Painting Carpentry Drywall Landscaping and more, Learn Marketing Bussiness skills too. This course is a combination of the follow classes only: Basic Electrical; Basic Plumbing; Plastering/Drywalls; Wall & Floor Tiling; Bathroom & Kitchen. Online courses for handymans to earn certifications · 1. Construction Site Electrical System Design · 2. Maintenance Planning Basics · 3. Learn to Repair &. Internet Connection. As our classes are conducted entirely online, a stable internet connection is essential. · Basic Computer Skills. Our course materials. Bundles →. A hand-picked selection of DIY University courses grouped around a specific focus area. Learn More →. Skill Workshops →. Foundational skills. In the meantime look up everything you can online. Subscribe to the Journal of Light Construction and Fine Homebuilding. Lots of good stuff in those and. Handymen and -women possible. If you have never studied online before, please don't worry. You will be guided every step of the way and if you get stuck. This Handyperson/Handyman Online Course includes a Free CPD accredited certificate, no hidden fees and % money-back guarantee. Handyman Courses, Training, and Certification · Village Of North Riverside · Aging In Place Cumberland · Lewistown Public Schools · Home Repair Resource Center. Course Overview. Are you looking to gain a new in-demand skill from the comfort of your home? · Learning Outcomes · Entry Requirement · Why choose us? · Will I. Handyman Specialist – Spring – Course # – Start Date 2/1/25 Learn the basic principles of electricity, carpentry, and plumbing. Upon completion. Learn Home Repair today: find your Home Repair online course on Udemy. Become Your Own Handyman LLC. Rating: out of (). 47 total hours Handyman Training School offers handyman training in the Metro Atlanta area. Register online today and start your new career! If you are looking for a. Some online providers offer free handyman training. FAQs. What handyman training do I need? Handyman skills cover a broad range of small jobs around the home –. Course Description · Introduction to handyman work in general · How to meet clients and establish the requirements of the job · What supplies, equipment and tools. Learn basic DIY home repair skills to fix your house yourself and save hundreds of $$$ with our General Home Maintenance course. Sign up now! online videos. Upvote ·. 93 Many adult education schools offer courses in basic handyman training. Master in-demand skills such as carpentry; plumbing; painting; and other trades through our Handyperson course; Acquire a handyperson's fix-it mentality. The Best-in-Class Online Handyman Training Service · Please email us to find out about our new handyman training events we are offering; · Get a free minutes. The Advanced Certificate of Handyman & Renovation Skills is a self paced online course dealing with the duties that a handyman or renovator would need to know.

Opportunities For Accredited Investors

Accredited investors are experienced investors with a high net worth. For this reason, they have access to certain investment opportunities that are not. Only accredited investors can invest with Gatsby Investment. You can apply for verification through our website, using a third-party service; “Verify Investor.”. As an online commercial real estate investing marketplace, all of our investment opportunities are available only to accredited investors. What is an accredited investor anyway? · Annual income of $, or more ($, if you're married), or · Net worth of $1 million or more other than your. 8 Opportunities Worth Looking At · 1. Venture Capital Investing · 2. Hedge Fund Investing · 3. Multifamily Syndication · 4. Real Estate Investment Trusts (REITs). Accredited investors have access to a much wider range of investment opportunities to make money. These include real estate syndications, hedge funds, private. What does being an Accredited Investor allow someone to do? For the most part, it allows them to invest in private investment opportunities. This designation allows them to access certain private market investment opportunities not available to many retail investors. To qualify as an accredited. In , several exciting opportunities are emerging for accredited investors, particularly in the realm of regulation crowdfunding. Accredited investors are experienced investors with a high net worth. For this reason, they have access to certain investment opportunities that are not. Only accredited investors can invest with Gatsby Investment. You can apply for verification through our website, using a third-party service; “Verify Investor.”. As an online commercial real estate investing marketplace, all of our investment opportunities are available only to accredited investors. What is an accredited investor anyway? · Annual income of $, or more ($, if you're married), or · Net worth of $1 million or more other than your. 8 Opportunities Worth Looking At · 1. Venture Capital Investing · 2. Hedge Fund Investing · 3. Multifamily Syndication · 4. Real Estate Investment Trusts (REITs). Accredited investors have access to a much wider range of investment opportunities to make money. These include real estate syndications, hedge funds, private. What does being an Accredited Investor allow someone to do? For the most part, it allows them to invest in private investment opportunities. This designation allows them to access certain private market investment opportunities not available to many retail investors. To qualify as an accredited. In , several exciting opportunities are emerging for accredited investors, particularly in the realm of regulation crowdfunding.

Meeting the financial requirements to be considered an accredited investor opens up various investment opportunities. Being an accredited investor can allow. Real estate investing for accredited investors with PeerStreet as defined by the SEC, domiciled in the U.S. Know more about investment opportunities for. However, if you can qualify as an accredited investor, you can access additional investment opportunities, which may have more complicated risk/reward. I have been accredited for about 10 years. It has allowed me to invest in about a dozen private placement investments, mostly real estate. Under the amendments, an LLC is considered an accredited investor when (i) it has at least $5,, in assets and (ii) it has not been formed solely for the. As an online commercial real estate investing marketplace, all of our investment opportunities are available only to accredited investors. An accredited investor is a seasoned participant in non-SEC registered investments. To qualify, they must meet minimum defined wealth specifications. Accredited investors have numerous opportunities to diversify their portfolios including alternative asset classes like real estate syndications, hard money. Real estate investing for accredited investors with PeerStreet as defined by the SEC, domiciled in the U.S. Know more about investment opportunities for. Meeting the financial requirements to be considered an accredited investor opens up various investment opportunities. Being an accredited investor can allow. Accredited investors can invest money in the profitable world of private equity, private placements, venture capital, hedge funds, and equity crowdfunding. Accredited investors also have access to investment opportunities that are not available to non-accredited investors. For example, hedge funds and private. Opportunities for accredited investors include having access to certain types of investments, like private equity shares, start-up companies, and real estate. In short, the advantage to being an accredited investor is that you have an opportunity to hear about more deals, gain access to them, and ultimately invest in. Regardless of your network, be vigilant about your investment opportunities. Always do your own due diligence, know how liquid your investment will be, and. Accredited Investors Wealth Management hires talented professionals who possess intellectual curiosity, a commitment to service, and a passion for our cultural. What Is an Accredited Investor? · Banks · Insurance companies · Trusts or limited liability corporations (LLCs) with assets over $5 million · Broker-dealers and. This designation allows them to access certain private market investment opportunities not available to many retail investors. To qualify as an accredited. The biggest example of opportunities available to accredited investors is private equity investments, such as venture capital deals or direct investments in. Accredited investor opportunities include Private Equity, Venture Capital & Hedge Funds, but The Kona Estates is one of the best options today.

Does Healthy Paws Cover Dental

They cover only accidental trauma (i.e. a fractured tooth). Embrace covers dental illness under our accident and illness insurance policy up to $1, per. No vet exam coverage · No wellness or preventative care coverage · No prescription food coverage · No behavioral therapy coverage · No dental disease coverage · No. A portion got denied because they said it was dental and it was not covered. From the Exclusions and Limitations they quoted in their reasoning. *Healthy Paws does cover hereditary conditions, though pets enrolled after age 6 are not eligible for hip dysplasia coverage. *With Embrace, pets enrolled after. During your dog or cat's dental cleaning (sometimes called a prophylaxis), plaque and tartar are removed from a pet's teeth, and the health of the entire mouth. Coverage Notes. Healthy Paws offers one, simple pet insurance plan that covers up to 90% of vet bills when your dog or cat gets sick or injured. Pumpkin insurance plans cover treatment for dental and periodontal illnesses. Healthy Paws insurance plans don't. Pumpkin plans cover behavioral issues. Healthy. The vets at Healthy Paws Veterinary Center offer dental care for cats and dogs. Visit us today. Healthy Paws Pet Insurance Doesn't Offer Dental Illness Coverage. Healthy Paws does not cover dental illness including gingivitis, malocclusions, periodontal. They cover only accidental trauma (i.e. a fractured tooth). Embrace covers dental illness under our accident and illness insurance policy up to $1, per. No vet exam coverage · No wellness or preventative care coverage · No prescription food coverage · No behavioral therapy coverage · No dental disease coverage · No. A portion got denied because they said it was dental and it was not covered. From the Exclusions and Limitations they quoted in their reasoning. *Healthy Paws does cover hereditary conditions, though pets enrolled after age 6 are not eligible for hip dysplasia coverage. *With Embrace, pets enrolled after. During your dog or cat's dental cleaning (sometimes called a prophylaxis), plaque and tartar are removed from a pet's teeth, and the health of the entire mouth. Coverage Notes. Healthy Paws offers one, simple pet insurance plan that covers up to 90% of vet bills when your dog or cat gets sick or injured. Pumpkin insurance plans cover treatment for dental and periodontal illnesses. Healthy Paws insurance plans don't. Pumpkin plans cover behavioral issues. Healthy. The vets at Healthy Paws Veterinary Center offer dental care for cats and dogs. Visit us today. Healthy Paws Pet Insurance Doesn't Offer Dental Illness Coverage. Healthy Paws does not cover dental illness including gingivitis, malocclusions, periodontal.

Both offer end-of-life coverage and dental accidents but only ManyPets covers dental illness. ManyPets has an add-on wellness plan, which will cover routine. No pet insurance company covers pre-existing conditions, and most plans do not cover wellness visits like annual exams or teeth cleaning. Healthy Paws. While Trupanion includes dental illness coverage in its standard policy, Healthy Paws doesn't, but does offer alternative treatment coverage, which is only. If your dog or cat needs more than their teeth cleaning, Paw Protect provides dental insurance coverage to protect your pet. We cover dental treatment related. Healthy Paws doesn't cover any form of dental disease and only covers accidents like broken teeth. Get your price. Fetch covers hip dysplasia in dogs 6+ years. Healthy Paws says it will cover elements of dental health care if caused by injury from an accident. It will not cover routine dental care (this is fairly. Healthy Paws does not offer coverage for routine care such as dental cleanings, vaccinations, flea control, heartworm medication, de-worming, nail trim. Wellness Plan Coverage. Plans will vary, but in general, they cover items that you can plan and prepare for such as annual wellness exams, vaccinations and. Fetch covers the treatment of dental injury and disease to all permanent teeth. However, the company requires the pet to have an annual dental and health. Healthy Paws doesn't cover costs resulting from your pet's dental illness. It will only cover costs associated with unexpected dental injuries. Like Trupanion. Healthy Paws Pet Insurance plans do not cover any vet exam fees. Pumpkin plans cover dental illnesses. Healthy Paws plans don't. With 70% of cats and 80% of. (Note: Healthy Paws has an unlimited payout structure.) Healthy Paws does not cover veterinary exam fees. Dental coverage for accidents and illnesses is limited. Wellness Plan Coverage. Plans will vary, but in general, they cover items that you can plan and prepare for such as annual wellness exams, vaccinations and. Odie covers endodontic treatment for canine and carnassial teeth as long as your pet is free of any signs of Periodontal disease before the Policy effective. Does the Healthy Paws pet insurance plan cover dental cleanings? The Healthy Paws pet insurance plan does not cover routine dental health care required to. Does the Healthy Paws pet insurance plan cover dental cleanings? The Healthy Paws pet insurance plan does not cover routine dental health care required to. If your dog or cat needs more than their teeth cleaning, Paw Protect provides dental insurance coverage to protect your pet. We cover dental treatment related. Annual dental exam is required to maintain limited dental coverage. Cost of Healthy Paws Pet Insurance, LLC. If there are questions regarding the. Healthy Paws covers the costs of some dental care related to accidents and does not provide a complete summary of any company's coverage. Consult. Regular teeth cleaning and other kinds of pet dental care can be costly, but making sure that dental cover is incorporated in your pet insurance.

Building Credit Without Debt

Staying current on your loan payments and reducing debt can help you continue to build credit. Keep in mind that falling behind on payments for secured loans. Credit cards are considered revolving credit. · Car loans and mortgages are types of fixed-installment credit. · Bank installment loans can be secured by. You can only build credit by using credit. Get a secured card and use it sparingly. Then get a store or gasoline card and use it sparingly. Soon. This free program enables you to not only track your credit activity with regular reports and alerts, but also raise your score and build a credit history with. Get a secured credit card, use it sparingly, and pay off the balance in full each month. · Become an “authorized user” on an account whose. If you can pay off your credit card balance in full each month, that helps. If you make your monthly mortgage payment every month without delay, that's huge. In. 1. Credit-builder loan · 2. Personal loans · 3. Car loan · 4. CD loan · 5. Federal student loan · 6. Peer-to-peer loans. Secured credit card: Secured cards work a lot like regular credit cards, except that you “secure" a line of credit up front by paying a deposit. · Student loan. If you don't qualify for a traditional unsecured loan, you might qualify for a loan secured with collateral, such as funds in a Certificate of Deposit account. Staying current on your loan payments and reducing debt can help you continue to build credit. Keep in mind that falling behind on payments for secured loans. Credit cards are considered revolving credit. · Car loans and mortgages are types of fixed-installment credit. · Bank installment loans can be secured by. You can only build credit by using credit. Get a secured card and use it sparingly. Then get a store or gasoline card and use it sparingly. Soon. This free program enables you to not only track your credit activity with regular reports and alerts, but also raise your score and build a credit history with. Get a secured credit card, use it sparingly, and pay off the balance in full each month. · Become an “authorized user” on an account whose. If you can pay off your credit card balance in full each month, that helps. If you make your monthly mortgage payment every month without delay, that's huge. In. 1. Credit-builder loan · 2. Personal loans · 3. Car loan · 4. CD loan · 5. Federal student loan · 6. Peer-to-peer loans. Secured credit card: Secured cards work a lot like regular credit cards, except that you “secure" a line of credit up front by paying a deposit. · Student loan. If you don't qualify for a traditional unsecured loan, you might qualify for a loan secured with collateral, such as funds in a Certificate of Deposit account.

Compare credit builder cards · 1. Get on the electoral roll · 2. Make sure your name is on household bills · 3. Take out a personal loan · 4. Repay outstanding. dollar icon. Tip: Building Good Credit · Develop a budget and stick to it. · Save money so you're prepared for a rainy day. · Pay your bills on time. · Keep your. Payment history · Credit utilization ratio · Types of credit used · How long you've been using credit · Total balances on all debts you owe · Public records, such as. If you pay on time, it can help build your credit. Paying utility bills on time is also a credit builder. Ask your phone, water, electric, gas or cable company. Low Utilization means you're not using too much of the credit extended. Upvote. Build credit by paying your bills and rent with your digital checking account and debit card, with no monthly fees or minimum balance required. Compare credit builder cards · 1. Get on the electoral roll · 2. Make sure your name is on household bills · 3. Take out a personal loan · 4. Repay outstanding. 1. Become an authorized user · 2. Get a small personal loan · 3. Report alternate payments like rent · 4. Try Brigit's Credit Builder*. How to build credit Establishing credit can be done in a variety of ways. You may already be taking actions that affect your credit score without knowing it. A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a. Other actions, such as making repayments to a federal loan under your name to applying for a phone line (if the phone company reports to credit bureaus) can. 4 ways to build credit with no credit history · 1. Get a secured loan or credit card · 2. Become an authorized user on someone else's account · 3. Use a cosigner. Explore products and services, including opening a checking account, finding a home loan, applying for a credit card and more. Bank of America services. Learn. When you experience a financial challenge, your credit record could suffer. Rebuilding it takes time. There are no shortcuts or secrets. The steps below can. There are also ways to build your credit history without a credit card. It's important to keep up to date with any existing loans you have. This includes. It's important that you know your credit score, your debt-to-income ratio, and have a realistic gauge of your overall financial health before you start the. Make Purchases and Pay On Time. Making purchases and paying them off demonstrates to creditors that you are able to responsibly handle debt and can be trusted. Paying off debt, becoming an authorized user, and reporting bills to credit bureaus are a few ways to build your credit. Author. By Emily Batdorf. How To Build a Credit History · Apply for a Secured Credit Card · Become an Authorized User · Find a Co-Signer · Use Store Credit Cards · Warning · Finance With. These usually have low loan amounts to keep students from racking up a large debt. Secured credit card: A secured credit card could be another good option. It.

Can I Withdraw Cash Value From Life Insurance

Option 1: Withdraw your entire cash value. Let's say you have a whole life policy you have been paying into for a while and you want or need money. · Option 2. You can surrender the policy and exchange it for the value. You can take a loan against the cash value, which may or may not incur interest, depending on the. Withdrawals: Policyholders can withdraw money from their cash value at any time, for any reason. This can be useful in times of financial need or for planned. You can tap into your policy's cash value by making a withdrawal or taking a loan against your policy. It is important to understand that policy loans and. I know this may get some down votes, but at this point your cash value is an asset on your balance sheet and you can use it. If I were you, I. When you withdraw funds or loan money from a cash value life insurance policy it can alter the policy's death benefit. When you take out a policy loan and fail. You can take money out OR you can cancel the policy and they have to pay you whatever is left in the account. Now here are the things they don't. The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw. Note that not all policies offer all the access to. Withdrawal In most situations, you can take a cash withdrawal from your permanent life policy, and that money will not be subject to income taxes if it's less. Option 1: Withdraw your entire cash value. Let's say you have a whole life policy you have been paying into for a while and you want or need money. · Option 2. You can surrender the policy and exchange it for the value. You can take a loan against the cash value, which may or may not incur interest, depending on the. Withdrawals: Policyholders can withdraw money from their cash value at any time, for any reason. This can be useful in times of financial need or for planned. You can tap into your policy's cash value by making a withdrawal or taking a loan against your policy. It is important to understand that policy loans and. I know this may get some down votes, but at this point your cash value is an asset on your balance sheet and you can use it. If I were you, I. When you withdraw funds or loan money from a cash value life insurance policy it can alter the policy's death benefit. When you take out a policy loan and fail. You can take money out OR you can cancel the policy and they have to pay you whatever is left in the account. Now here are the things they don't. The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw. Note that not all policies offer all the access to. Withdrawal In most situations, you can take a cash withdrawal from your permanent life policy, and that money will not be subject to income taxes if it's less.

Surrender value refers to the amount a person would receive if they withdraw money from their own life insurance policy's cash value. can withdraw funds from. This is called a withdrawal. However, some policies may restrict when and how much cash value you can withdraw. Some policies may have a minimum withdrawal. Instead of your beneficiaries receiving the death benefit, you as the policyholder will receive the cash value your whole life insurance policy has built up. Withdrawals: You can take withdrawals from the policy's available cash value without interest charges. A withdrawal charge may apply and any policy. In certain types of policies, you can take a policy withdrawal from the accumulated cash value in your policy. Since this method reduces the total cash value. Yes. You can easily take money out of the cash value of your life insurance policy as a tax-free withdrawal up to the amount you've paid in premiums;. You can withdraw the money to help pay for retirement or to pay your life insurance premiums. You can also take out a loan against the cash value of the policy. How do I cash in a life insurance policy? · Use the cash value to pay your premiums · Make a partial withdrawal · Borrow against the policy · Surrender the policy. As your policy's accumulated cash value grows, you can use it to make premium payments, borrow money, or even withdraw cash. How does cash value life. You have the option, with cash value, to surrender your policy and withdraw the total cash value of your policy. If you do surrender your policy though, you. One can do this by taking out a loan against the policy, surrendering the policy, or making a withdrawal Types of Life Insurance Policies with Cash Value. Withdrawals: Policyholders can withdraw money from their cash value at any time, for any reason. · Loans: Another option is to take out a loan against your cash. Please be advised that a withdrawal against your universal life policy may cause the policy to lapse if it is not adequately funded. As well, this transaction. If your policy does allow such withdrawals, any withdrawal you make will typically be tax free up to your basis in the policy. Your basis is the amount of. Both types of life insurance provide death benefit coverage. While term life insurance offers protection that is designed to last for a specific period of. You may be able to make a tax-free withdrawal from your permanent life insurance policy. But, if your withdrawal exceeds the amount you've paid so far into the. Withdrawal: You can withdraw a portion of the cash value. Keep in mind that withdrawing more than you've paid in premiums could be taxable. Loan: You can take a. The cash value within a life insurance policy represents the equity that is tied to the death benefit. It acts similarly to the equity you hold. You can use your cash value by borrowing against it, withdrawing some of it, or withdrawing it all at once and surrendering the policy. (Withdrawals over. When you borrow against your policy, you take a loan from the life insurance company with your cash value as collateral. When you do this, you usually have your.

Reo Investment

Whether you're buying the property to live in or as an investment, these are 5 essential steps you should keep in mind for success with bank-owned properties. If you're an investor, buying an REO is a great way to participate in real estate activities. Investing in REO properties can provide a lucrative profit margin. An REO property is created when no one purchases the house at the auction, forcing the bank to buy the property back itself. Whether you're buying the home to live in or as an investment, these 10 steps should help set you up for success with bank-owned properties. A primary way to realize a profit through REO investing is to renovate a distressed property, then sell it for more than the initial purchase price plus the. Decker Suite , Irving Texas () [email protected] () © REO Investments LLC. All Rights Reserved. WhatsApp. The acronym for REO means real estate owned. This term is most often associated with foreclosures or other properties that are owned by banks, mortgage lenders. What are REO properties? REOs are lender-owned properties that didn't sell at a foreclosure auction. Lenders (banks, other financial institutions, and investors). Real Estate Owned (REO) properties are a valuable investment opportunity for savvy real estate investors. Learn more about this term and its benefits. Whether you're buying the property to live in or as an investment, these are 5 essential steps you should keep in mind for success with bank-owned properties. If you're an investor, buying an REO is a great way to participate in real estate activities. Investing in REO properties can provide a lucrative profit margin. An REO property is created when no one purchases the house at the auction, forcing the bank to buy the property back itself. Whether you're buying the home to live in or as an investment, these 10 steps should help set you up for success with bank-owned properties. A primary way to realize a profit through REO investing is to renovate a distressed property, then sell it for more than the initial purchase price plus the. Decker Suite , Irving Texas () [email protected] () © REO Investments LLC. All Rights Reserved. WhatsApp. The acronym for REO means real estate owned. This term is most often associated with foreclosures or other properties that are owned by banks, mortgage lenders. What are REO properties? REOs are lender-owned properties that didn't sell at a foreclosure auction. Lenders (banks, other financial institutions, and investors). Real Estate Owned (REO) properties are a valuable investment opportunity for savvy real estate investors. Learn more about this term and its benefits.

5 Tips for Investors Who Want to Work With REO Brokers · Be Prepared to Explain your Goals · Show proof of funds · Provide references · Show your experience. REO property management for bank and investor owned properties. NFR will clean, maintain, and restore properties to their original state. REO Investment Group provides a % Turn-key REO system that provides properties that are free and clear of any liens, in livable condition, under a % fully. Access our resources to learn about Fannie Mae real estate owned (REO) properties and how to become a Fannie Mae REO listing agent and vendor. REO Investment Group provides a % Turn-Key REO/Foreclosure System that provides properties at pennies on the dollar that are free and clear of any liens. REO refers to a lender-owned property that is not sold at a foreclosure auction. Properties become REO when owners default and the bank repossesses them and. It's a powerful tool for measuring the profitability of a rental property investment, and it provides investors with a clear picture of how much they can expect. The Risks With Buying REO Foreclosures. Many new investors conclude that it's automatically a great deal because the property is listing as a foreclosure. In. USR sources both equity and debt investments through non-traditional and off-market transactions and generates returns through capital injection. Decker Suite , Irving Texas () [email protected] () © REO Investments LLC. All Rights Reserved. WhatsApp. We offer funding options to solve your capital needs. Rates as low as % for year fully-amortized investment property financing and % for fix-and-. The acronym for REO means real estate owned. This term is most often associated with foreclosures or other properties that are owned by banks, mortgage lenders. This comprehensive guide will help you learn more about the process of buying REO properties, including how properties end up in foreclosure. REO is a bank-owned property that failed to sell at a foreclosure auction. When homeowners fail to pay their mortgages, they can either sell their property. How to Buy REO Properties as a Real Estate Investment If you want to buy an REO property, you'll want to work with an experienced real estate agent who can. % Turn-key REO Foreclosure System that provides properties at pennies on the dollar that are free and clear of any liens, in saleable condition. We're working hard to improve preREO website and system. For any inquiries, please contact us at. [email protected] Investor Login. A property's value doesn't always match its sales price when bought at an auction, which is terrible news for the lender or investor. One significant factor is. When buying an REO property, the bank doesn't do a standard title transferinstead, they deliver a "Standard Warranty Deed" which holds them accountable only. Investment Portfolio Review · Portfolio Management Services · Retirement Portfolio. BlogHow to Successfully Manage Your Real Estate Owned (REO) Portfolio.

Live Prices Of Cryptocurrencies

The global cryptocurrency market cap today is $T, a +% change from 24 hours ago. · Get cryptocurrency prices for 4, assets. All cryptocurrencies ; focusIcon. BitcoinBTC. $57, ; focusIcon. EthereumETH. $2, ; focusIcon. Tether USDtUSDT. $ ; focusIcon. BNBBNB. $ Today's Cryptocurrency Prices ; 1. BTC. Bitcoin. BTC. $55, $55, +%. +% ; 2. ETH. Ethereum. ETH. $2, $2, +%. +%. - The live price of BTC is $ with a market cap of $B USD. Discover current price, trading volume, historical data, BTC news. Cryptocurrency Prices · PairPrice, USDTDynamics, 24h · Bitcoin BTC/USDT. 57,+% · WhiteBIT Coin WBT/USDT. +% · Ethereum ETH/USDT. 2,+%. Check the current price, daily change, and market capitalization on the rsps.site cryptocurrency prices page. Follow the live price charts and start trading. Yahoo Finance's complete list of crypto currencies offers up-to-the-minute prices, percentage change, volume, open interest, and daily charts. Live cryptocurrency prices and charts of top cryptocurrencies by crypto market cap. Complete cryptocurrency market overview including Bitcoin and View top cryptocurrency prices live, crypto charts, market cap, and trading volume. Discover today's new and trending coins, top crypto gainers and losers. The global cryptocurrency market cap today is $T, a +% change from 24 hours ago. · Get cryptocurrency prices for 4, assets. All cryptocurrencies ; focusIcon. BitcoinBTC. $57, ; focusIcon. EthereumETH. $2, ; focusIcon. Tether USDtUSDT. $ ; focusIcon. BNBBNB. $ Today's Cryptocurrency Prices ; 1. BTC. Bitcoin. BTC. $55, $55, +%. +% ; 2. ETH. Ethereum. ETH. $2, $2, +%. +%. - The live price of BTC is $ with a market cap of $B USD. Discover current price, trading volume, historical data, BTC news. Cryptocurrency Prices · PairPrice, USDTDynamics, 24h · Bitcoin BTC/USDT. 57,+% · WhiteBIT Coin WBT/USDT. +% · Ethereum ETH/USDT. 2,+%. Check the current price, daily change, and market capitalization on the rsps.site cryptocurrency prices page. Follow the live price charts and start trading. Yahoo Finance's complete list of crypto currencies offers up-to-the-minute prices, percentage change, volume, open interest, and daily charts. Live cryptocurrency prices and charts of top cryptocurrencies by crypto market cap. Complete cryptocurrency market overview including Bitcoin and View top cryptocurrency prices live, crypto charts, market cap, and trading volume. Discover today's new and trending coins, top crypto gainers and losers.

The current price of Bitcoin (BTC) is 57, USD — it has risen % in the past 24 hours. Try placing this info into the context by checking out what coins. Most Active Cryptocurrencies. Start Trading Futures ; Bitcoin. 56, ; Ethereum. 2, ; Tether. ; Binance Coin. Bitcoin's market cap is currently $ billion. Bitcoin's market cap is calculated by multiplying the price of 1 BTC with the amount of BTC that are currently. Track cryptocurrency markets with live prices, charts, free portfolio, news and more. Use this page to assess cryptocurrency prices live. View market cap data, total volume and volume across the past 24 hours. On our website and the Ledger Live app, you can find the latest prices Cryptocurrencies with high cap rank higher and have a larger share of the market. Crypto market cap is calculated by multiplying the total number of coins in circulation by their current price. What cryptocurrencies have the largest market. The live Bitcoin price today is $ USD with a hour trading volume of $ USD. We update our BTC to USD price in real-time. Crypto Recommendation · Bitcoin · Buy now. Current Price. ₹47,76, 1D returns · Ethereum · Buy now. Current Price. ₹1,97, 1D returns · BNB · Buy now. All Cryptocurrencies price in Indian Rupee (INR) ; BTC. Bitcoin · ₹51,06, ; ETH. Ethereum · ₹2,11, ; USDT. Tether USDt · ₹ ; BNB · ₹46, ; SOL. Cryptocurrency Prices ; Bitcoin. BTCUSD. $54, ; Ether. ETHUSD. $2, ; Tether. USDTUSD. $ ; Solana. SOLUSD. $ ; USD Coin. USDCUSD. $ Bitcoin price, market cap on Coin heatmap. BTC. Bitcoin. 55,, % ; Ethereum price, market cap on Coin heatmap. ETH. Ethereum. 2,, % ; Binance. View crypto prices and charts, including Bitcoin, Ethereum, XRP, and more Do Not Share My Personal Information; Digital Asset Disclosures. Learn. Bitcoin. Find a list of top cryptocurrencies and their prices in real time, including percentage change, charts, history, volume and more. See live cryptocurrency prices and compare the performance of different coins. With crypto prices constantly changing, we'll help you stay up to date. Top 50 cryptocurrencies · 1 Bitcoin BTC. $ 57, $ T $ trillion · 2 Ethereum ETH. $ 2, $ B $ billion · 3 Tether USD USDT. $. Bitcoin news, USD price, real-time (live) charts. Learn about BTC value, bitcoin cryptocurrency, crypto trading, and more. About crypto prices · 1. Bitcoin (BTC) · 2. Ethereum (ETH) · 3. Tether (USDT) · 4. BNB (BNB) · 5. USD Coin (USDC) · 6. XRP (XRP) · 7. Bitget Token (BGB) · 8. Cardano . On Kriptomat, you will easily find information about all cryptocurrencies. The most popular are the Bitcoin price, Ethereum price, and Solana price pages. These. Get the latest price, news, live charts, and market trends about Bitcoin. The current price of Bitcoin in United States is $ per (BTC / USD).

Mutual Of Omaha Medicare Supplemental Insurance Reviews

Mutual of Omaha maintains an A+ rating with the Better Business Bureau 2. Mutual of Omaha Medicare Supplement Plans. Having Medicare doesn't mean all of. United of Omaha is a subsidiary of Mutual of Omaha. They have an A.M. Best and S&P Rating of A+ (Superior). With fantastic customer support, a high rating, and. Medicare supplement insurance policies generally covers the 20% of health costs that original Medicare doesn't. My Insurance Premium went from $ per month to $ per month without any notification. I contacted Mutual of Omaha and ncanceled. There's only 1 Medigap plan available if you live in Wisconsin. See what's covered and review important plan information. You should review your health and prescription needs annually and Mutual of Omaha Insurance Company. Mutual of Omaha Plaza. Omaha. Best Medigap High-Deductible Plan G Provider: Mutual of Omaha · Ratings: A+ from AM Best · Discounts: Discounts on vision, hearing, and healthy living products. Mutual of Omaha enjoys an A+ rating from AM Best, which rates the financial stability of insurance companies. This is the highest available financial rating for. A.M. Best rates United World an A+ (superior) on the grounds of overall financial strength and ability to meet ongoing obligations to policyholders. This rating. Mutual of Omaha maintains an A+ rating with the Better Business Bureau 2. Mutual of Omaha Medicare Supplement Plans. Having Medicare doesn't mean all of. United of Omaha is a subsidiary of Mutual of Omaha. They have an A.M. Best and S&P Rating of A+ (Superior). With fantastic customer support, a high rating, and. Medicare supplement insurance policies generally covers the 20% of health costs that original Medicare doesn't. My Insurance Premium went from $ per month to $ per month without any notification. I contacted Mutual of Omaha and ncanceled. There's only 1 Medigap plan available if you live in Wisconsin. See what's covered and review important plan information. You should review your health and prescription needs annually and Mutual of Omaha Insurance Company. Mutual of Omaha Plaza. Omaha. Best Medigap High-Deductible Plan G Provider: Mutual of Omaha · Ratings: A+ from AM Best · Discounts: Discounts on vision, hearing, and healthy living products. Mutual of Omaha enjoys an A+ rating from AM Best, which rates the financial stability of insurance companies. This is the highest available financial rating for. A.M. Best rates United World an A+ (superior) on the grounds of overall financial strength and ability to meet ongoing obligations to policyholders. This rating.

hours. Omaha, NE · Health & Medical · Health Insurance Offices. Mutual of Omaha. Mutual of Omaha. (51 reviews). Health Insurance Offices, Life Insurance. Reputation and Customer Experience - 5 / 5. Mutual of Omaha has a lower than average NAIC complaint ratio, suggesting that most of its customers are happy with. Mutual of Omaha Insurance Company. Individual Market-Attained Age. Mutual of Omaha Plaza. Marketing Method: Insurance Producer Solicited. Omaha, NE Mutual of Omaha Medicare Supplement Plans are highly popular in Arizona and usually have the lowest rates. High Satisfaction Ratings: Recent consumer surveys show that 94% of all Mutual of Omaha customers were satisfied with their supplement coverage. 90% would. We picked Mutual of Omaha for all our insurance needs, including my husbands' medicare supplement plan, because of the 12 percent discount for every member of. They both also have an AM Best rating of A+ (Superior). For more information on Nationwide read our full review. Mutual of Omaha Insurance Company · Business rating icon of a+ superior. A.M. Best Company, Inc. For overall financial strength and ability to meet ongoing. The company has an A+ rating from the Better Business Bureau and an A+ (Superior) rating on its financial strength from AM Best. Compare Plans & Rates. Should you choose Mutual of Omaha, or one of its subsidiaries, such as United World Life Insurance Company or Omaha Supplemental Insurance Company, for your. Looking for Medicare Supplement Insurance? Get a quote online and speak with licensed agents from Mutual of Omaha to learn more. Mutual Of Omaha offers Medicare supplement plans A, F, G and N depending on the state you are in. Plans A and F are offered in ALL states. Concurrently, AM Best has affirmed the Long-Term Issue Credit Ratings (Long-Term IRs) of “a” (Excellent) of Mutual of Omaha Insurance Company's surplus notes. . Mutual of Omaha Insurance Company (Individual), 6, X, X, X, X, X, X, X. Transamerica Consumer Questions and Complaints. If you are unable to find the answer. Company Explanation: United World Life Insurance is a subsidiary of the Mutual of Omaha. Non-tobacco rates. USAA Life Insurance Company. Customer Service. Medicare supplement insurance policy forms are underwritten by United World Life Insurance Company, Mutual of Omaha Plaza, Omaha NE Policy Forms. You should review your health and prescription needs annually and Mutual of Omaha Insurance Company. Mutual of Omaha Plaza. Omaha. The Better Business Bureau gives the Mutual of Omaha family of companies an A+ rating with only complaints in the last three years. The majority of these. On Mutual of Omaha's Website. Get A Quote, On Medicare Supplement's Website. Company Logo. Forbes Health Ratings. Choose from ten standardized Medicare. They both also have an AM Best rating of A+ (Superior). For more information on Nationwide read our full review.